Welcome to the world of online selling, where entrepreneurs thrive and customers await.

But hold on!

The dreaded Goods and Services Tax (GST) number requirement might be standing in your way.

Fear not, my savvy sellers!

In this article, we’ll explore how you can sell online without a GST number.

So, grab a seat, buckle up, and let’s dive into the e-commerce adventure together.

We’ll explore the possibilities, unveil the strategies, and share invaluable insights for those eager to carve their online selling path without the burden of a GST number.

But first of all, let’s start with the basics.

What is a GST Number?

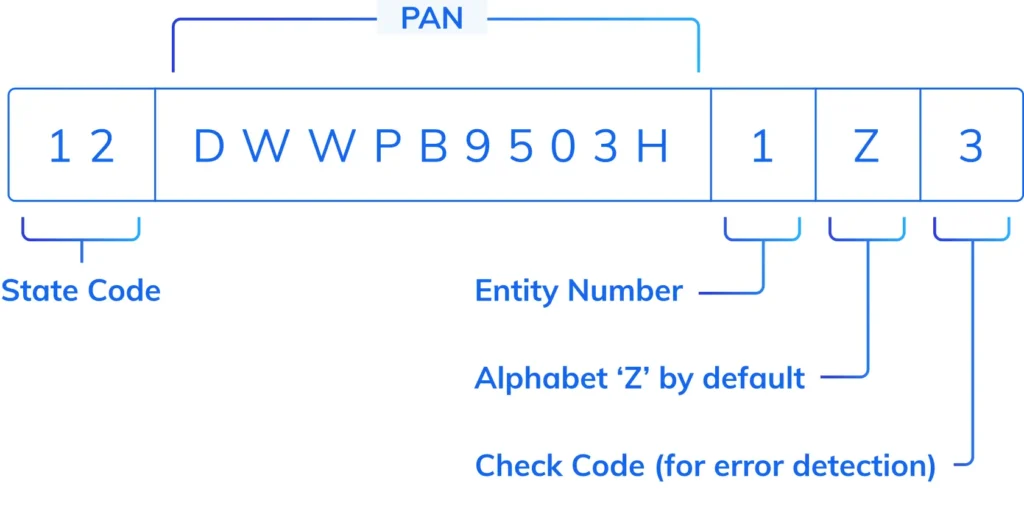

It’s like a unique ID for businesses, kind of like your own secret code. The full name is Goods and Services Tax Identification Number, but we’ll just call it the GST number for short.

So, here’s the deal: when a business wants to sell stuff online or do business, they usually need to get a GST number.

It’s like a way for the government to keep track of what the business is selling and how much tax they need to pay.

It’s important because taxes help the government provide services like schools, hospitals, and roads.

Think of it as a secret agent ID that helps the government know who’s doing business and make sure everyone plays by the rules.

Without a GST number, it’s like trying to play a game without following the rules—it can lead to some big problems.

You Can Visit the Official GST Portal India: GST.GOV.IN (This Portal Only For India)

Why is a GST number important for selling online?

In our country India, having a GST number is mandatory for businesses engaged in selling goods or services online. It ensures compliance with tax regulations and enables the government to track revenue and collect taxes.

Additionally, a GST number provides credibility to your online business and enhances customer trust.

Selling Online without GST Number: Easy Ways to Make It Happen

So, you’re ready to dive into the exciting world of selling stuff online, but wait… what’s that thing called GST number?

I’m here to show you how you can sell online without dealing with all that complicated GST stuff.

Let’s keep it simple and easy to understand, just like a conversation with your best friend!

1. Online Marketplaces are Your BFFs:

Imagine having a helpful friend who takes care of all the tax stuff for you.

That’s exactly what online marketplaces like Etsy, eBay, and Amazon do!

They handle tax-related things so you can focus on selling your cool products.

You don’t even need a GST number to start selling certain products on these platforms.

2. Your Own Online Shop is a Cool Option:

If you want to sell directly through your own website or social media, you may not need a GST number at first.

It’s like setting up a lemonade stand in your front yard—you can sell your stuff without all the extra paperwork.

But as your business grows, it’s important to keep an eye on your sales and chat with a tax pro to make sure you’re following the rules.

So, my friends, selling online without a GST number is totally possible!

Just remember to choose the right online marketplace, keep an eye on your sales if you have your own shop.

Alternative options for selling online without GST number

Selling your products or services online without a GST number might sound like a tough challenge, but fear not!

There are alternative options available that can help you navigate this obstacle with ease. L

Let’s explore a couple of these options in simple terms:

1. Team Up with a GST-Registered Partner:

Imagine you have a friend who already has a GST number. You can collaborate with them by selling your products or services through their business.

It’s like joining forces and using their GST number to stay compliant with the rules while you focus on what you do best.

2. Look for Special Programs:

Some states have special programs designed for small businesses like yours. These programs exempt you from needing a GST number if you meet certain criteria.

It’s like finding a secret door that allows you to sell online without worrying about the GST stuff.

So, do some research and see if there’s a program like this in your state.

By exploring these alternative options, you can keep your online selling dreams alive without the hassle of obtaining a GST number.

Pros and cons of selling online without GST number

Selling your products or services online is an exciting venture, but when it comes to having a Goods and Services Tax (GST) number, there are both pros and cons to consider.

Let’s break it down into simple terms:

Pros:

1. Easy Peasy Setup: Selling online without a GST number means you can skip all the complicated paperwork. It’s like a shortcut to getting your business up and running faster.

2. Saving Cash: Not having a GST number can actually save you money. You won’t have to pay registration fees, file tax returns, or deal with other costly stuff. This is super helpful, especially if you’re just starting out or have a tight budget.

3. Freedom to Explore: Selling without a GST number gives you the freedom to test the waters. You can try different ideas and see what works without worrying about tax responsibilities right away. It’s like dipping your toes in the pool before taking a big dive.

Cons:

1. Smaller Audience: Selling without a GST number might limit your reach. Some customers prefer to buy from registered businesses because it makes them feel more confident about tax stuff and the trustworthiness of the seller. It’s like choosing a known candy brand over a mystery one.

2. Competitive Disadvantage: In certain industries, having a GST number can give you an advantage. Customers may think registered businesses are more legit and professional, so they might choose them over non-registered sellers. It’s like picking a popular video game over an unknown one.

3. Legal Trouble: Selling without a required GST number can get you into hot water with the law if the authorities find out. Each country has its own tax rules, and breaking them can lead to serious consequences. It’s like breaking the rules at school and facing detention.

So, there you have it—selling online without a GST number has its perks and drawbacks. It’s important to weigh these factors based on your specific situation and understand the laws in your country. Remember, it’s always good to play by the rules and make informed choices.

Platforms to Sell Products Online Without GST Number in India

Selling products online in India has become a popular business venture, but the requirement of a Goods and Services Tax (GST) number can be a barrier for some sellers.

However, there are platforms that allow you to sell products online without the need for a GST number.

Here’s a list of platforms that provide this opportunity:

1. Etsy

It Is Known for its focus on handmade and unique products, Etsy allows sellers in India to create online stores without requiring a GST number. It provides a global marketplace and offers a user-friendly platform for artisans and crafters to showcase their products.

2. eBay

eBay is a renowned online marketplace that enables sellers to reach a wide customer base. In India, sellers can create listings and sell products without a GST number. However, it’s important to keep track of your sales volume to ensure compliance as your business grows.

3. Amazon Global Selling

Amazon Global Selling program allows Indian sellers to access international markets without the need for a GST number. By registering under this program, sellers can list and sell products on Amazon’s global marketplaces and reach customers worldwide. Read Sell On Amazon India By Clicking Here.

4. Shopify

Shopify is a popular e-commerce platform that provides tools for creating and managing online stores. In India, sellers can utilize Shopify to sell products without a GST number. It offers customizable themes, secure payment options, and various marketing features to enhance the selling experience.

5. Facebook Marketplace

Facebook Marketplace provides a platform for individuals and businesses to buy and sell products locally. As of now, sellers can list and sell products on Facebook Marketplace without a GST number. It’s a convenient option to reach a local audience and establish connections within the community.

6. Instamojo

Instamojo is a payment gateway and e-commerce platform that allows sellers in India to create online stores without a GST number. It offers features such as integrated payment solutions, inventory management, and order tracking to facilitate the selling process.

7. Meesho

Meesho is a popular platform that focuses on enabling individuals to start their own online businesses. Sellers can sell products through social media platforms without the need for a GST number. Meesho provides a catalog of products, order management, and logistics support. Read Sell On Meesho By Clicking Here.

8. Flipkart

Flipkart (Limited Categories), one of India’s largest e-commerce platforms, allows sellers to sell products without a GST number in limited categories. However, it’s important to check the specific category requirements and comply with the regulations as per Flipkart’s guidelines. Read Sell On Flipkart By Clicking Here.

These platforms provide opportunities for sellers to showcase their products, reach a wide customer base, and grow their online businesses without the immediate need for a GST number.

However, it’s crucial to stay updated on the latest tax regulations and consult with professionals to ensure compliance as your business expands.

Important: Please note that while these platforms currently allow selling without a GST number, regulations may change over time. It's advisable to verify the requirements and compliance guidelines on each platform before starting your online selling journey.

Products That Can Be Sold Online Without GST Number (GST-Exempt Products)

Here’s a list of products that can be sold online without the need for a Goods and Services Tax (GST) number.

These products fall under GST-exempt categories, allowing sellers to offer them without the burden of GST compliance:

1. Books and Educational Materials: Textbooks, fiction, non-fiction, educational materials, and other publications are often exempt from GST. This includes both physical books and e-books.

2. Fresh Fruits and Vegetables: Fresh fruits, vegetables, and produce are generally exempt from GST. Sellers can offer these products online without the requirement of a GST number.

3. Unprocessed Food Items: Basic unprocessed food items like grains, pulses, milk, eggs, and natural honey are often exempt from GST. Sellers can sell these food products without the need for a GST number.

4. Healthcare Services: Services related to healthcare, such as doctor consultations, diagnostic tests, hospital services, and medical treatment, are typically exempt from GST.

5. Public Transportation: Services provided by public transportation entities, including railways, metro systems, and buses, are generally exempt from GST.

6. Postal Services: Sending letters, postcards, or parcels through postal services is usually exempt from GST. Online sellers can offer these services without a GST number.

7. Educational Services: Educational services offered by recognized institutions, such as schools, colleges, and universities, are often exempt from GST. This includes courses, workshops, and training programs.

8. Insurance: Insurance policies, including life insurance, health insurance, and vehicle insurance, are typically exempt from GST.

9. Financial Services: Certain financial services like banking, loans, and investments are exempt from GST. Sellers offering these services online do not require a GST number.

10. Exported Goods: Goods that are exported outside the country are zero-rated for GST. Sellers engaging in export activities can sell these goods without a GST number.

11. Exempted Services: Certain services, such as religious services, government services, and services provided by nonprofit organizations, are exempt from GST.

It’s important to note that the Sellers should always refer to the specific tax laws and consult with professionals to ensure compliance and understand the eligibility for selling these products without a GST number.

Tips for Successfully Sell Online Without GST Number: Your Path to E-Commerce Success

If you’re selling online without a GST number, here are some simple tips to help you succeed while following the rules:

1. Know the Tax Laws: It’s important to understand the tax laws in your country or region. Learn about the rules for online selling, like when you need to register for a GST number. Knowing the thresholds and exemptions will keep you on the right track.

2. Keep Good Records: Keep track of your sales, expenses, and all the money that comes in and goes out. Good records help you see how your business is doing and make sure you’re following the tax rules. It’s like having a clear map to guide you.

3. Ask for Expert Help: Sometimes, you need a little help from someone who knows the tax stuff. Talk to a tax professional or an accountant who can give you advice and keep you updated on any changes in the rules. They’re like your personal tax superheroes!

4. Make Customers Happy: When you don’t have a GST number, building trust with your customers becomes super important. Treat them well, answer their questions quickly, and send their orders on time. Happy customers mean more sales and a better reputation.

5. Consider Registering: If your business is growing fast and you think you might need a GST number soon, think about registering voluntarily. It can make your business look more professional, open doors to new opportunities, and make tax time easier.

Remember, selling online without a GST number can be a successful adventure as long as you follow the rules and keep your customers happy.

So, put on your entrepreneurial hat, take these tips to heart, and get ready to conquer the e-commerce world!

Conclusion

Alright, my entrepreneur friend! Sell online without a GST number can be a cool way to get started in the online marketplace without dealing with all those tax hassles right away.