The term “payment gateway” refers to an e-commerce service that processes credit or debit card transactions when customers make purchases online. It is a secure and reliable method of transmitting payment information from the customer’s browser to the merchant’s server.

Table of Contents

What is the Meaning of Payment Gateway?

A payment gateway is essentially an online equivalent of a point-of-sale (POS) machine that one finds at a traditional brick-and-mortar store. The difference is that a payment gateway allows for real-time processing of financial transactions without the need for physical cards to be present.

Payment gateways typically encrypt sensitive information – such as credit card numbers – to ensure that it can only be read by the intended recipient.

In order to use a payment gateway in India, a customer must usually provide their billing details, such as name, address, and card number. This information is then transmitted to the merchant’s bank for authorization.

If the transaction is approved, funds are transferred from the customer’s account to the merchant’s account.

Why Use Payment Gateway In India?

There are several benefits to using a payment gateway In India for online transactions in India:

Payment gateways employ advanced encryption techniques to ensure that customer data is kept safe and secure.

- They also come with fraud detection tools that can help merchants identify and prevent fraudulent transactions.

With a payment gateway, customers can make purchases without needing to have cash on hand or physically swipe a card.

- This makes it faster and more convenient for customers to complete transactions.

Payment gateways allow merchants to accept payments from customers all over the world, making it easier to expand their business beyond India.

By accepting various payment options, including credit and debit cards, net banking, and mobile wallets, merchants can attract more customers and increase sales.

Overall, payment gateways have become an integral part of e-commerce in India, offering secure and convenient ways for customers to make purchases online while allowing merchants to accept payments from customers all over the world.

Payment gateway tools are important for online businesses that need to accept payments from customers in a fast and secure manner. There are many payment gateway tools available, below are payment gateway list:

- Zoho Checkout: This payment gateway tool allows businesses to customize their payment pages and also provides support for multiple payment options.

- Razorpay: This payment gateway tool offers a simple checkout process and supports various payment methods, including credit/debit cards, net banking, UPI, and more.

- Cashfree: This is another popular payment gateway tool in India that offers a range of payment options, including cards, net banking, UPI, and more.

- Instamojo: This payment gateway tool is designed for small businesses and startups and offers easy integration with websites and apps.

- Ccavenue: This payment gateway tool offers a range of payment options, including credit/debit cards, net banking, wallets, and more.

- PayU: This payment gateway tool offers a range of payment options across multiple countries and has a robust fraud detection system.

- Billdesk: This payment gateway tool is used by many large businesses in India and offers various payment options and features like recurring payments and refunds.

- PayPal: This is a well-known payment gateway tool that supports various payment options and currencies across multiple countries.

- Atom: This payment gateway tool offers a range of payment options, including credit/debit cards, net banking, and more.

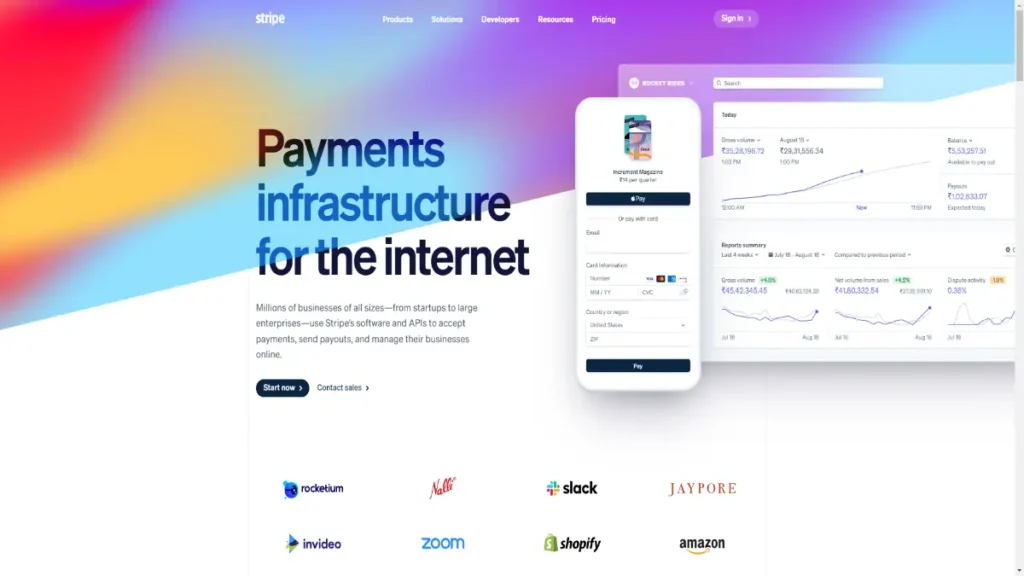

- Stripe: This payment gateway tool is popular among startups and offers easy integration with websites and apps, as well as support for various payment options.

These payment gateway tools offer different features and pricing plans, so it’s important to choose one that best fits your business needs.

1. Zoho Checkout

Zoho Checkout is a payment gateway service that allows businesses to accept online payments from customers. Here are some of its pros and cons along with its unique features:

Pros:

Cons:

Unique Features:

- Subscription Billing: Zoho Checkout offers subscription billing, allowing businesses to automatically bill their customers regularly reducing administrative work.

- Multi-lingual Support: Zoho Checkout supports multiple languages, making it accessible to customers in different regions.

- Webhooks: Zoho Checkout has webhooks, allowing businesses to receive real-time notifications about their transactions and automate certain processes.

2. Razorpay

Razorpay is a payment gateway service that allows businesses to accept online payments from customers. Here are some of its pros and cons along with its unique features:

Pros:

Cons:

Unique Features:

- Smart Collect: Razorpay offers a feature called Smart Collect that allows businesses to collect payments from customers using a payment link or an API integration, without requiring them to have a website.

- Route Optimization: Razorpay has a route optimization feature that automatically routes transactions through the most reliable payment mode, ensuring higher transaction success rates.

- Dynamic 3D Secure: Razorpay uses dynamic 3D Secure authentication that requires customers to enter a one-time password (OTP) only if deemed suspicious, reducing friction during the checkout process.

3. Cashfree

Cashfree is a payment gateway service that allows businesses to accept online payments from customers. Here are some of its pros and cons along with its unique features:

Pros:

Cons:

Unique Features:

- Auto Collect: Cashfree offers a feature called Auto Collect that allows businesses to collect payments through bank mandates, enabling recurring payments and reducing administrative work.

- Split Payments: Cashfree has a split payments feature that allows businesses to split the payment received between different stakeholders, such as vendors or affiliates, automatically.

- Instant Settlements: Cashfree offers instant settlements to merchants at an additional cost, allowing them to receive payments instantly instead of waiting for two business days.

4. Instamojo

Instamojo is a payment gateway service that allows businesses to accept online payments from customers. Here are some of its pros and cons along with its unique features:

Pros:

Cons:

Unique Features:

- Link-Based Payments: Instamojo offers a unique feature called link-based payments that allows businesses to create a payment link and share it with customers via email, SMS, or social media, enabling them to pay without leaving the platform.

- Integrated Logistics: Instamojo has an integrated logistics feature that allows businesses to ship products to their customers seamlessly by generating shipping labels and tracking orders from a single dashboard.

- Pre-Order Payments: Instamojo allows businesses to accept pre-order payments for upcoming products or services, helping them generate revenue before the launch.

5. CCavenue

CCavenue is a payment gateway service that allows businesses to accept online payments from customers. Here are some of its pros and cons along with its unique features:

Pros:

Cons:

Unique Features:

- Dynamic Routing: CCavenue has a dynamic routing feature that automatically routes transactions through the most reliable payment mode, ensuring higher transaction success rates.

- Multi-Currency Checkout: CCavenue offers a multi-currency checkout feature that allows businesses to accept payments in different currencies, facilitating international transactions.

- Smart Analytics: CCavenue has a smart analytics feature that provides insights into sales trends, customer behavior, and payment modes, helping businesses make data-driven decisions.

6. PayU

PayU is an online payment gateway that allows businesses to accept payments through various methods, such as credit/debit cards, net banking, and digital wallets. Here are some of its pros and cons along with its unique features:

Pros:

Cons:

Unique feature:

One of PayU’s unique features is its “deferred payments” option, which allows customers to pay for their purchases at a later date. This feature can be particularly useful for businesses selling high-value items or services, as it provides customers with more flexibility in managing their finances while also increasing sales potential for the business. Additionally, PayU offers a mobile SDK (Software Development Kit) that enables businesses to integrate PayU directly into their mobile apps, providing a seamless payment experience for customers on-the-go.

7. BillDesk

BillDesk is an online payment gateway that enables businesses to accept payments through various modes, such as credit/debit cards, net banking, and digital wallets. Here are some of its pros and cons along with its unique feature:

Pros:

Cons:

Unique feature:

One of BillDesk’s unique features is its “one-click payments” option, which allows customers to save their payment details securely with BillDesk for future transactions. This feature can significantly reduce the time and effort required for repeat purchases, increasing customer satisfaction and loyalty.

Additionally, BillDesk offers a “split payments” feature that enables businesses to split payments across multiple vendors or accounts, simplifying accounting processes and improving accuracy.

8. Paypal

PayPal is an online payment gateway that enables businesses to accept payments through multiple modes, including credit/debit cards, net banking, and digital wallets. Here are some of its pros and cons along with its unique feature:

Pros:

Cons:

Unique feature:

One of PayPal’s unique features is its “PayPal Credit” option, which allows customers to finance their purchases with flexible payment terms. This feature can increase sales potential for businesses by providing customers with more purchasing power while also generating interest revenue for PayPal.

Additionally, PayPal offers a “Virtual Terminal” feature that enables businesses to accept payments over the phone or via mail order, expanding payment options for customers who prefer not to transact online.

9. Atom

Atom is an online payment gateway that enables businesses to accept payments through multiple modes, including credit/debit cards, net banking, and digital wallets. Here are some of its pros and cons along with its unique feature:

Pros:

Cons:

Unique feature:

One of Atom’s unique features is its “Smart Collect” option, which enables businesses to collect recurring payments from customers automatically. This feature can simplify billing processes for subscription-based businesses and reduce the risk of missed payments.

Additionally, Atom offers a “Split Settlement” feature that enables businesses to split payments across multiple vendors or accounts, simplifying accounting processes and improving accuracy.

10. Stripe

Stripe is an online payment gateway that enables businesses to accept payments through multiple modes, including credit/debit cards, net banking, and digital wallets. Here are some of its pros and cons along with its unique feature:

Pros:

Cons:

Unique feature:

One of Stripe’s unique features is its “Stripe Atlas” option, which enables businesses to incorporate a company in the United States as a foreign entrepreneur. This feature provides businesses with access to funding, legal tools, and other resources to help them grow and expand globally.

Additionally, Stripe offers a “Radar” feature that uses machine learning to identify and prevent fraudulent transactions, increasing security and protecting businesses against losses.

Conclusion

Payment gateways are one of the key components of e-commerce, allowing customers to make online purchases quickly and securely. In India, there are many different payment gateway providers to choose from, each with its own strengths and weaknesses.

By selecting the right payment gateway, businesses can offer their customers a seamless checkout experience and expand their reach globally.

FAQ About Payment Gateway In India

What is a payment gateway in India?

A payment gateway is an online platform that enables merchants to accept electronic payments from customers. It acts as an intermediary between the customer’s bank and the merchant’s bank, facilitating the transfer of funds securely and efficiently.

What are the popular payment gateways in India?

There are several popular payment gateways in India, including Paytm, Razorpay, CCAvenue, Instamojo, and PayU. Each of these gateways has its own set of features and pricing plans, so merchants should choose the one that best fits their business needs.

What are the fees associated with using a payment gateway in India?

The fees associated with using a payment gateway in India can vary depending on the gateway and the specific pricing plan chosen by the merchant. Typically, payment gateways charge a transaction fee of around 1-3% of the transaction value, as well as a fixed per-transaction fee. Some gateways may also charge a setup fee or a monthly maintenance fee.

How long does it take to set up a payment gateway in India?

The time it takes to set up a payment gateway in India can vary depending on the gateway and the merchant’s specific requirements. Typically, it takes anywhere from a few hours to a few days to set up a payment gateway. However, some gateways may require additional documentation or verification, which could extend the setup process.

Is it safe to use a payment gateway in India?

Yes, it is safe to use a payment gateway in India. Payment gateways use advanced encryption and security protocols to protect sensitive customer information, such as credit card details and bank account numbers. Additionally, many payment gateways in India are certified by international security standards, such as PCI DSS, ensuring that they meet the highest security standards.